Overview of business dashboard

This page provides bird’s eye view of your bookkeeping activities. It can indicate what bookkeeping tasks need to be completed.

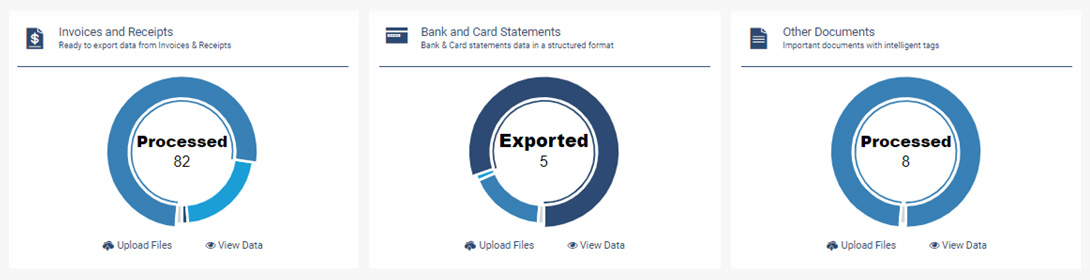

Document Type Counts

It shows counts for each document type by status which can be used to identify documents at different processing stages.

You can click on the “View Data” link to view further details of the documents or to upload new documents, click on the “Upload Files” button below the pie-chart of the relevant document type.

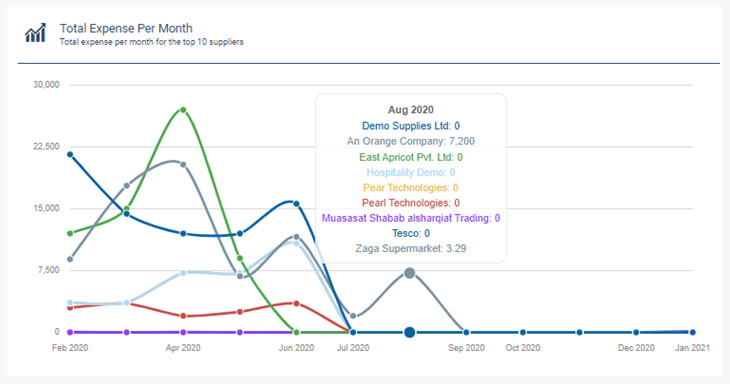

Expenditure trends for top ten suppliers

The line chart shows the past twelve months’ trend of expenses data of your top ten suppliers in Receipt Bot. It can be used to quickly identify any missing documents for major suppliers.

Suppose the chart is showing a decreasing expense trend for a particular supplier, then you should review if the bills for the relevant supplier are being received.

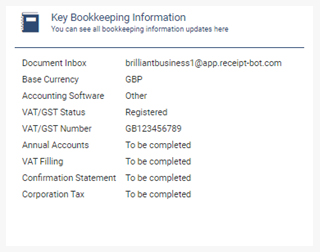

Key Bookkeeping Information

‘Key bookkeeping’ section provides crucial information related to a business such as a document inbox, base currency, integrated accounting software, VAT registration status, and key accounting dates relevant to a business.

The key accounting dates are another feature in Receipt Bot that is designed to aid accountants in managing any deadlines for a business. An example is a VAT filing deadline that requires VAT returns to be submitted regularly, you can simply add a new deadline in Receipt Bot and the system will keep showing it on the dashboard to keep reminding you about it. To further read about managing key dates, please refer to the following help article; Manage key business dates and deadlines